Homeowners Insurance in and around Spring Valley

Looking for homeowners insurance in Spring Valley?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Princeton

- Ladd

- Cherry

- Arlington

- LaMoille

- Depue

- Seatonville

- Granville

- Mark

- Standard

- Cedar Point

- Hollowayville

- Tiskilwa

- Wyanet

- Hennepin

- Malden

- Bureau

- Peru

- Oglesby

- McNabb

There’s No Place Like Home

Everyone knows having excellent home insurance is essential in case of a tornado, hailstorm or windstorm. But homeowners insurance is about more than covering natural disaster damage. Another helpful thing about home insurance is that it also covers you in certain legal cases. If someone has an accident on your property, you could be held responsible for their medical bills or their lost wages. With good home coverage, your insurance may cover those costs.

Looking for homeowners insurance in Spring Valley?

Give your home an extra layer of protection with State Farm home insurance.

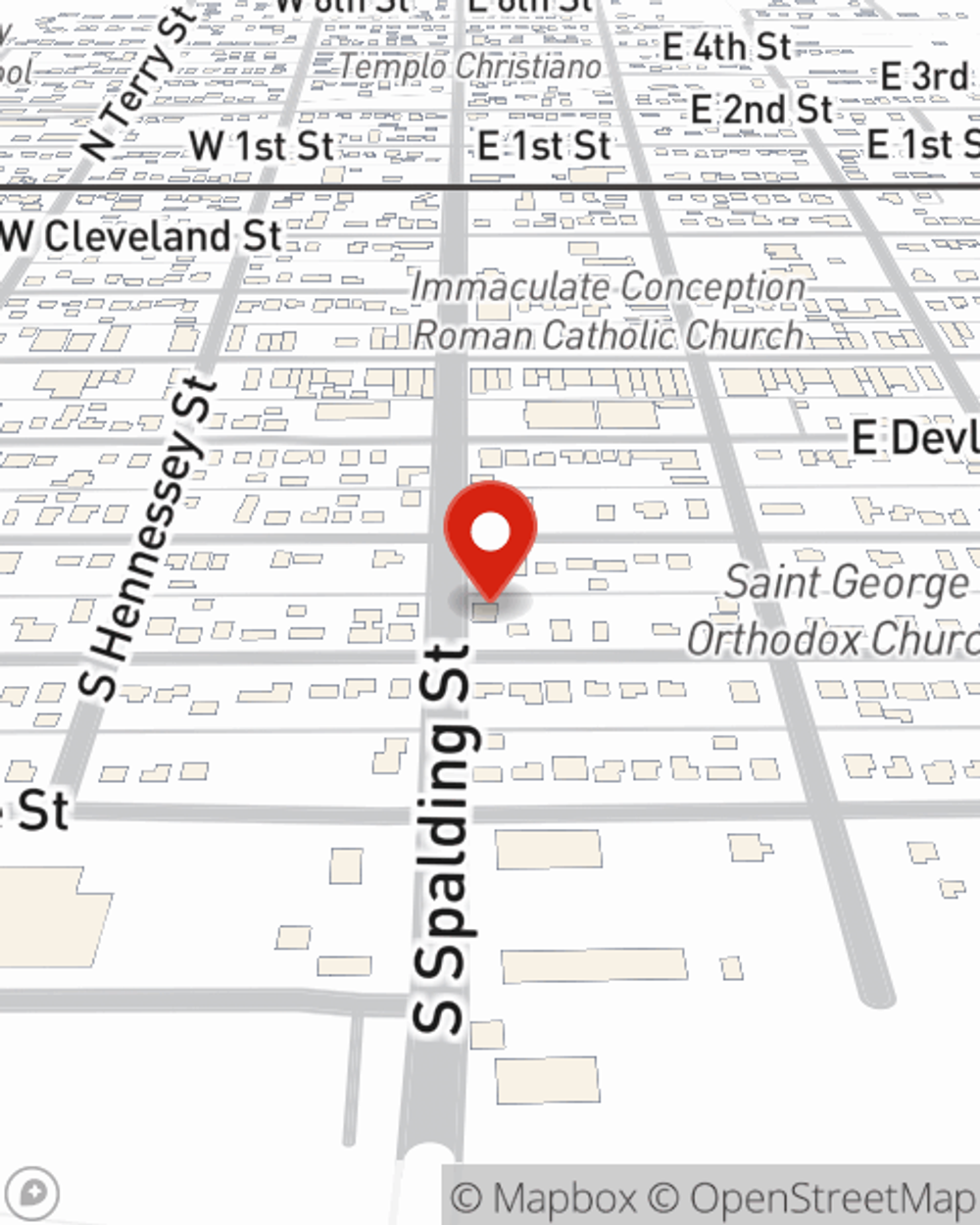

Agent Cody Burroughs, At Your Service

With this great coverage, no wonder more homeowners choose State Farm as their home insurance company over any other insurer. Agent Cody Burroughs would love to help you find a policy that fits your needs, just reach out to them to get started.

For terrific protection for your home and your possessions, check out the coverage options with State Farm. And if you're ready to lay the foundation for a home insurance policy, reach out to State Farm agent Cody Burroughs's office today.

Have More Questions About Homeowners Insurance?

Call Cody at (815) 664-5302 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.

Cody Burroughs

State Farm® Insurance AgentSimple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.